Nektar Therapeutics (NKTR:NASDAQ) commenced a Phase 2b clinical trial evaluating its lead product candidate rezpegaldesleukin (REZPEG or NKTR-358), in patients with severe to very severe alopecia areata, a disease-causing patchy hair loss, according to a news release. Initial data are expected in H1/25.

"The start of this Phase 2b study is another significant milestone for Nektar as we advance REZPEG, a potentially transformative new mechanism for alopecia areata and other autoimmune disorders," Chief Medical Officer Dr. Mary Tagliaferri said in the release.

She explained that a currently unmet need exists for an alopecia areata treatment having a favorable safety profile and lasting results, one that targets the cause, a dysfunction of the immune system in this case.

REZPEG works by targeting the body's interleukin-2 (IL-2) receptor complex, which then stimulates the proliferation of regulatory T cells to bring the immune system back into balance, the release explained. Nektar is also evaluating REZPEG in atopic dermatitis.

Nektar has a lawsuit pending against Eli Lilly & Co. in which it accused Lilly of wrongdoing related to the two companies' partnership to develop and possibly commercialize REZPEG, according to a Reuters article.

As for the just-initiated Phase 2b trial, it is global, randomized, double-blind, placebo-controlled, and being done to evaluate the safety and efficacy of REZPEG in treating alopecia areata. A total of 84 patients will be dosed with either one of two REZPEG doses or a placebo during the 36-week induction treatment period. After this, patients will be followed for 24 more weeks to evaluate durability.

The study's primary efficacy endpoint will be mean percent improvement in the Severity of Alopecia Tool (SALT) at week 36. Secondary endpoints include the number of participants with a 50% or higher reduction in SALT at week 36 and at certain other times. Another endpoint is the mean percent improvement in SALT at specific times.

In other news, Nektar will give a presentation at H.C. Wainwright & Co.'s 2nd Annual Autoimmune & Inflammatory Disease Virtual Conference scheduled for 1:30 p.m. EST on Thursday, March 28, 2024.

Robust Drug Pipeline

Headquartered in San Francisco, California, Nektar Therapeutics is developing medicines for the treatment of immunological and oncological disorders and has a portfolio of already-approved partnered drugs.

Andy Hsieh, biotech analyst at William Blair, has a Market Perform rating on Nektar and a price target implying an 11% return for investors.

The biotech's other drug in the clinic is NKTR-255, an IL-15 receptor agonist, being evaluated in combination with other therapies in various solid and hematological cancers. NKTR-255 is designed to boost the immune system's inherent ability to fight cancer.

As for the biotech's preclinical drug candidates in the pipeline, there are two potential treatments for autoimmune diseases. NKTR-0165 is a bivalent tumor necrosis factor receptor type II agonist antibody. The PEG-CSF Protein is a polyethylene glycol-modified hematopoietic colony-stimulating factor protein.

"As we build our pipeline in immunology, we are also conducting Investigational New Drug-enabling studies for NKTR-0165, our novel agonist antibody targeting TNFR2," said President and Chief Executive Officer Howard Robin.

This life sciences firm stands out, in part, for its strong team and its proven track record, the company said.

Lawsuit Win Could Boost Stock

Nektar has a lawsuit pending against Eli Lilly & Co. in which it accused Lilly of wrongdoing related to the two companies' partnership to develop and possibly commercialize REZPEG, according to a Reuters article.

The introduction to the suit, filed in August 2023, alleged the following: "After entering into the joint development agreement with Nektar regarding REZPEG and committing to spearhead its development, Lilly purchased another company with a competing drug candidate that was also under development. Thereafter, Lilly executed on a scheme to ensure that REZPEG would never succeed."

Nektar could prevail in this case, Founder and Editor Ron Struthers purported in a February issue of Struthers' Resource Stock Report. He pointed out that Lilly paid Nektar US$150 million (US$150M) initially and was due to, but did not, remit another US$250M milestone payment.

"Assuming Nektar wins the case, I would expect they would at least get the milestone payments of US$250M and maybe much more, like US$500M or US$600M," wrote Struthers.

Earlier in March, when Nektar announced a US$30M private placement financing with TCGX, as noted in a news release, Eli Lilly's share price went up 1.3%.

Common Medical Disorder

The alopecia areata market is sizable, as in the U.S. alone, as many as 6.7 million people have the disease, according to the National Alopecia Areata Foundation.

About 2% of people around the world experience alopecia areata. While it affects people of all ages, it often starts in childhood.

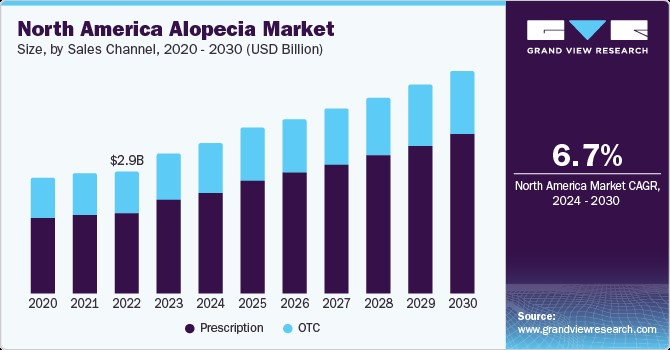

The global alopecia market is expected to continue its recent robust growth and, thus, reach US$7.82 billion (US$7.82B) in value in 2028, according to The Business Research Co.

This reflects a 7.9% compound annual growth rate from its 2024 value of US$5.76B. Growth drivers include aging populations, lifestyle factors, consumers' increasing concern about appearance, and spending more money on health care.

The Catalysts

Upcoming catalysts for Nektar include clinical updates about its investigative drugs and, eventually, a resolution of its lawsuit against Eli Lilly.

Struthers, for one, is bullish on the biotech. In his February newsletter, he highlighted that the company was trading at about a 58% discount to cash value.

Further, he went on, the chart of Nektar's stock indicated it had broken out to the upside, suggesting a new uptrend could follow. Struthers noted the first major resistance would be about US$1 per share (Nektar has not yet hit this), and the next would be about US$1.70, around the cash value. Were Nektar to win its lawsuit, Struthers opined, the stock could reach US$3 and possibly surpass it.

"Between the discount to cash value, potential positive results on their drug portfolio, and the lawsuit, I believe we have good odds to make some great returns here, and I like the chart also," he wrote.

Andy Hsieh, biotech analyst at William Blair, has a Market Perform rating on Nektar and a price target implying an 11% return for investors.

Ownership and Share Structure

According to Reuters, 11 strategic entities own 0.82%, or 1.51 million (1.51M) shares, of Nektar. The Top 5, from most to least percentage owned, are CEO Howard Robin with 0.28% or 0.51M shares, Director Robert Greer with 0.16% or 0.29M shares, Jillian Thomsen with 0.1% or 0.19M shares, Director Robert Chess with 0.08% or 0.15M shares and Chief Research and Development Officer Jonathan Zalevsky with 0.08% or 0.14M shares.

A total of 157 institutions hold 67.41% or 123.78M shares. The Top 5 are Deep Track Capital LP with 10.02% or 18.4M shares, The Vanguard Group Inc. with 6.56% or 12.04M shares, Acadian Asset Management LLC with 4.26% or 7.82M shares, PRIMECAP Management Co. with 3.81% or 7M shares and Monaco Asset Management SAM with 3.25% or 5.97M shares.

Retail investors own the remaining 31.77%.

Nektar Therapeutics has 183.62M outstanding shares and 182.11M free float traded shares.

The company has a market cap of US$165.26M and a 52-week trading range of US$0.41−$1.12 per share.

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.